Market Impact Analysis: CVD Investigation on Fertilizer Causing Tight U.S. Supply is Costing U.S. Farmers

From The Juday Group:

CVD Investigation on Fertilizer Causing Tight U.S. Supply is Costing U.S. Farmers

The U.S. International Trade Commission (ITC) announced on 29 June 2020 - more than six months ago - that it was initiating the preliminary phase of a countervailing duty investigation (CVD) on the imports of phosphate fertilizer from Morocco. That investigation was triggered by a petition from Mosaic Company, the largest phosphate fertilizer company in the U.S. historically enjoying nearly three-quarters of the U.S. market share.

Up to a third of domestic phosphate fertilizer demand is typically supplied by imports. Morocco, especially, is a key producer and long-time supplier to the U.S. market account for about 60 percent of the imported supply on which U.S. farmers rely. Morocco’s role in the supply of fertilizers is critical as it is home to more than 70 percent of the world’s phosphate reserves.

Tightening Supplies

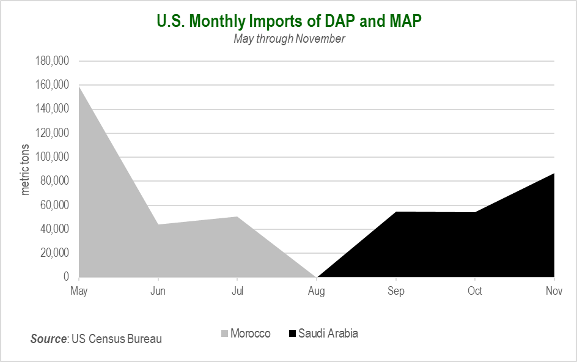

A final decision on whether to impose the duties is expected in February, however, under the CVD process, any potential duties imposed would be levied retroactively to June when the petition was filed. Thus, the CVD investigation process alone – before any action has been taken – has already halted imports from Morocco. By August, about 30 days after the CVD process started, imports of diammonium phosphate (DAP) and monoammonium phosphate (MAP) fertilizers from Morocco dropped to zero. Other less reliable suppliers have made up some of the gap, but overall total DAP and MAP. imports in 2020 are down about 11 percent from the previous 4-year average of 2016-2019 – even as demand rises.

Moreover, as Mosaic’s quarterly financial reports indicate, phosphates production from the dominant producer in the U.S. was down 138,000 metric tons, or about 2 percent for the first three quarters of 2020 compared to 2019. The company also reported lower inventories. This has left the market with very tight supplies in the first quarter of 2021 heading toward the spring planting season, and with inventory levels below where they would normally be at the start of a new year.

As Mosaic’s financial report sums up

Prices have risen throughout 2020 due to tightness in global supply and demand and a decrease in competitor shipments into North America. Competitor shipments were impacted by anticipation of potential import duties against producers in Morocco and Russia which may result from the countervailing duty investigations into imports of phosphate fertilizers. Phosphate selling prices have continued to strengthen into the fourth quarter of 2020. [1]

Fall Prices Up and Spring Prices Expect to Rise Further

Favorable weather conditions this fall, especially in the U.S. corn belt extended the fall application season into early December drawing down what supplies were available and adversely impacting inventory rebuilding. The combined effect of reduced domestic inventory and import supply, not only caused the standard benchmark Gulf of Mexico price increase but also was felt regionally with significant premiums in markets further up the Mississippi River and into the Midwest.

According to the USDA’s Agricultural Marketing Service (AMS) Production Cost Report, as of 14 January for Illinois, MAP prices are up by an average of more than $116/ton or 29 percent, and DAP prices are up by an average about $114/ton, or 28.5 percent since the week before the investigation was initiated.

With Morocco diverting its exports to non-U.S. destinations in the wake of the ongoing countervailing duty investigation, MAP barge prices in Brazil are now $15 to $30 lower than prices in the U.S. Gulf, a reverse of earlier in the year when U.S. prices were lower.

No Need for Countervailing Duties

The countervailing duty investigation is predicated on Mosaic’s claim of economic damage from unfair trade on the part of Morocco and Russia which resulted in low phosphate fertilizer prices in 2109 and early 2020. However, fertilizer prices during that period were simply following market fundamentals – almost a mirror image reverse of now. In the fall of 2018 wet conditions reduced fertilizer applications during fall field work, and fertilizer inventories built up, putting bearish pressure on prices. Then, the spring planting season of 2019 was impacted by the wettest weather in nearly 50 years, which reduced spring fertilizer applications. In 2019 there was a record 20 million acres which were prevented from planting due to weather – more than twice the previous record set in 2011.

Globally Competitive

Mosaic is the second largest integrated phosphate producer in the world operating in approximately 40 countries around the globe. The company is fully exposed to global market forces in the top four plant nutrient using countries in the world: China, India, Brazil and the U.S. In short, Mosaic competes with Moroccan fertilizer in a number of export markets; countervailing duties are not needed to compete domestically. According to the U.K. based international fertilizer market analytical firm Profercy

Mosaic is in regular price competition at prevailing market levels with Moroccan and Russian phosphates producers in numerous export markets. This has not been controversial at any point in recent years

In addition to owning and operating phosphate mines and fertilizer production, warehousing and distribution facilities in Brazil and Paraguay, Mosaic has a joint venture with the state owned Saudi Arabian Mining Company’s Ma’aden Wa’ad Al Shamal Phosphate Company. Mosaic’s domestic phosphate production and its marketing of imports from Saudi Arabia have been major beneficiaries of the CVD process targeted at Morocco.

Unintended Consequences

In the big picture, the primary impacts of the countervailing duties would be to

effectively cap the supply of fertilizers in the US. that would support higher fertilizer costs for farmers in the U.S.

divert phosphate products into the global market helping lower the relative input costs for farm export countries who compete against U.S. farmers.

Imposing countervailing duties on imported phosphate fertilizers is wrongheaded.

First, it wouldn’t address the key factors leading to current lower prices.

Second, it is a mis-applied long-term policy solution to a short-term market problem; countervailing duties are typically put in place for five years and can be extended after a review by the ITC.

Third, restricting imports through higher tariffs will only result in longer term adverse, unintended consequences.

# # #

[1] Mosaic Company SEC 10-K filing for the quarterly period ending September 30, 2020